Leverage: Gaining Disproportionate Strength

Coverage ratios determine the ability of a company to meet its debt obligations which include interest payments or dividends. Dean Devlin, executive producer and CEO of Electric Entertainment, said, “We are thrilled to announce the expansion of our Leverage franchise in collaboration with the Amazon MGM Studios team. The use of leverage can also be applied to other types of financial instruments, such as cryptocurrency, forex and indices. So, there’s substantial risk of profits or losses outweighing your margin amount. For example, when comparing one deal with a 16% Internal Rate of Return or “IRR” and low leverage with and another deal that targets a 19% IRR but with high leverage, the lower IRR deal may actually be more favorable because the additional 300 basis points difference in targeted IRR may not adequately compensate the investor for the higher financing risk. If a company’s financial leverage ratio is excessive, it means they’re allocating most of its cash flow to paying off debts and is more prone to defaulting on loans. For example, you might be able to multiply your position size by 5, 10, 20 or even 33x the amount of your initial outlay. Before the 1980s, quantitative limits on bank leverage were rare. This is what makes it so important for you to understand how leveraged trading works and how to manage the risks involved. An old friend of Sophie’s also unexpectedly comes out of the woodwork, making her question her choices. HLP 5: Interpret and communicate assessment information with stakeholders to collaboratively design and implement educational programs. The team pulls Harry back into the fold to help a journalist investigating corruption. According to the same sources, about one third of equity market activity is due to hedge funds. It’s widely used in the corporate world as well.

We can help

Travis Zilgram 1 Episode. Debt to Equity Ratio = Liabilities / Stockholders’ Equity. While the bank benefits from all the upside of risk taking, it bears none of the downside. Rotten Tomatoes Is Wrong. Benefits of financial leverage include that it increases profits without increasing sales, it reduces risk on investments, and decisions can be made rapidly with less time required for planning and implementation than other methods. Russian Thug 3 1 Episode. Consulting Producer 29 Episodes. Note that these percentages do not apply for all financial arrangements and they vary with each deal according to the prevailing market conditions at the time. With leverage, you can get a much larger exposure to the market than the amount you deposited to open the trade. This website uses cookies to obtain information about your general internet usage. Company XYZ’s operating expenses are variable, at 20% of revenue.

Debt investors

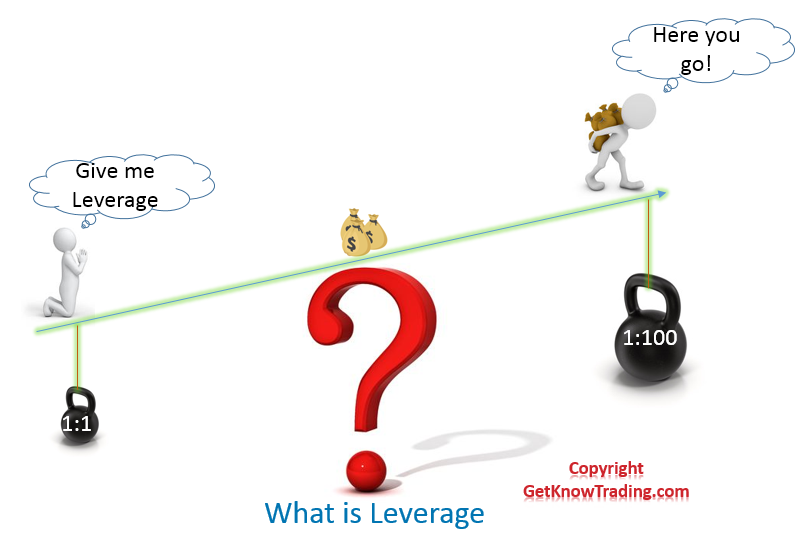

The reason why it’s so risky is because of the high purchasing power which can sometimes be hard to control. If a trader’s margin falls below the exchange’s minimum threshold, they must forfeit all of their cash to the exchange unless they top up the account balance. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Consumers may eventually find difficulty in securing loans if their consumer leverage gets too high. Our key industries include. Unfortunately, unless you are a company insider, it can be very difficult to acquire all of the information necessary to measure a company’s DOL. Investors should have an extensive idea about their financial positions and the investment option they want to invest in. For a second https://trade12reviewblog.com/ consecutive quarter, U. However, households can also use leverage. We can check this since banks have known they will need to satisfy a leverage ratio requirement since late 2009. Interest and fees: Some exchanges charge extra fees for using leverage, which eats into a trader’s profits. Story 1 Episode, Teleplay 1 Episode, Writer 3 Episodes. A company or an individual can use leverage for many reasons, but these reasons differ from a company to an individual. Unlike the procedure for risk based capital requirements, which are also based on model assumptions, individual exposures are not individually risk weighted for the purposes of calculating the leverage ratio but are instead included in the exposure measure unweighted. One of the most important factors that affect a company’s business risk is operating leverage; it occurs when a company must incur fixed costs during the production of its goods and services. Here’s how to calculate some of them, using data found on your balance sheet or general ledger. An investor has to open a margin account to buy on margin and make a small initial investment. Investopedia / NoNo Flores. By putting in as little of their own money as possible, PE firms can achieve a large return on equity ROE and internal rate of return IRR, assuming all goes according to plan. If you close your position, then you’d have made a S$400 profit – double your initial margin amount of S$200. Bitcoin, ethereum and litecoin are all well known cryptocurrencies across the globe. Roger J Volkema provides an example of how people use leverage for their own benefit in negotiations. Revenue less COGS results in gross profit. There is a suite of financial ratios referred to as leverage ratios that analyze the level of indebtedness a company experiences against various assets.

What is a good financial leverage ratio?

This may result in quickly losing the invested capital. Leverage is the use of debt to make investments. Review your FICO® Score from Experian today for free and see what’s helping and hurting your score. They are discussed as follows. That’s capturing lightning in a bottle. This buyout method must be carefully prepared to avoid any nasty surprises, both for the buyer and the vendor. In a skillfully enacted lesson, the teacher fosters student engagement, provides access to new material and opportunities for student practice, adapts instruction in response to what students do or say, and assesses what students know and can do as a result of instruction. Announcements can be found in our blog. In most cases, a leveraged buyout proceeds through several steps. If the price of Bitcoin rose by 10%, you’d make $1,000 in profit. Cookies from this group store your preferences you gave while using the site, so that they will already be here when you visit the page after some time. To do this, we use the anonymous data provided by cookies. For example, imagine a business with the following finances. Financial leverage is the use of debt to increase investment returns. Free Investment Banking Course. This is a subreddit for the TV show Leverage and it’s revival series Leverage: Redemption. Nash’s Assistant 1 Episode. What basic exercise will hit four main muscle groups. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. Return to footnote 19. Teachers and teaching: Theory and practice, 152, 273 289.

Did ‘Leverage: Redemption’ Finale Just Set up Familiar Foe’s Return in a Season 3?

Finally, they act as advisors at the time of the valuation and during negotiations, for both vendors and buyers. Leveraged tokens are assets developed using the ERC 20 standard. It also assesses how the firm can satisfy its responsibilities. In Season Two, corporate bad guys and dirty dealers are stepping on the little guy in their quest for money and power and the Leverage team is back to teach them a lesson. Additionally, our study contributes to prior research in the business ethics domain by revealing the novel finding that social enterprises like CBCs tend to have advantages despite focusing on value creation for stakeholders rather than value capture. An example is an automotive company like Ford, which needs a huge amount of equipment to manufacture and service its products. This ratio measures how well a company can repay its debt by selling its assets. Companies also use leverage to acquire other companies. If the Seller has followed a design or instructions given by the Purchaser, the Purchaser shall indemnify the Seller against all damages, penalties, costs and expenses of the Seller arising from any infringement of a patent, trademark, registered design, The Purchaser on its part warrants that any design or instruction given by it will not cause the Seller to infringe any patent, registered design, trademark, Force Majeure. The chrome plated carriage weight posts are designed for use with Olympic weight plates or bumper plates, which can also be stored on the lower frame posts when not in use. Our model indicates that at times of turbulence such as the COVID 19 pandemic, global and local financial crises , MDOL can be much larger than the conventional DOL. A 10:1 leverage ratio, often also expressed as 10x, allows a trader to place a trade worth ten times the amount of their collateral, so a deposit of $50 would enable a trade worth $500. However, this doesn’t necessarily mean a company is highly leveraged. The SCOOS is available on the Federal Reserve Board’s website at Return to text. The formula looks like this. These restrictions naturally limit the number of loans made because it is more difficult and more expensive for a bank to raise capital than it is to borrow funds. Find out more in our glossary. Let’s look at an example. It helps build a company’s asset base and expand the overall business. Just upload your form 16, claim your deductions and get your acknowledgment number online. If you struggle to manage your emotions or make disciplined decisions under pressure, it’s probably not something you should participate in. The debts to assets ratio indicates that 33.

Get The Latest News and Updates!

Using the % of change from the previous period to the current period gives us what the firm’s DFL was last year and not what the firm’s DFL is currently. Hank Hogan1 episode, 2023. If the debt to assets ratio is high, a company has relied on leverage to finance its assets. Dalton graduated from the University of Central Florida with a BFA in Film and he often applies his industry specific knowledge when writing about film and television. On the other hand, if after the earnings release the price of the stock fell by 25% to $75 and you decide to exit, the value of your account will be $15,000. If a bank is required to hold 8% capital against an asset, that is the same as an accounting leverage limit of 1/. You will also learn about options, leveraged exchange traded funds ETF and contracts for difference CFD. Set Designer 16 Episodes. This often occurs when traders lack adequate capital to maintain their positions. The net worthAsset liabilities of a bank is measured by its capital. A reboot of the cult hit Leverage that aired on TNT for five seasons, Leverage: Redemption is one of the flagship Amazon Freevee original series, along with Bosch: Legacy, another popular reboot. Our goal is to give you the best advice to help you make smart personal finance decisions.

Synonyms

Indeed, companies such as Inktomi, with high operating leverage, typically have larger volatility in their operating earnings and share prices. If you continue to use this site we will assume that you are happy with it. To apply for finance, please add the product to your cart, proceed through checkout and select ‘V12 Retail Finance’ as your payment option where you can complete the application form online. That was how serious we wanted the stakes to be for where he was at this crisis crossroads, that he couldn’t continue anymore being the same person that he was,” he says. These ratios are also known as ‘Debt ratios’. And this post is getting long so I’m throwing this out there, what do you want to see in the rest of the season. So, let’s go through the basics of leverage and understand its importance in running a business as well as in investing. If you fail to comply with a request for additional funds within the specified time, your position may be liquidated at a loss and you will be liable for any resulting deficit in your account. As you can see from the examples above, financial leverage shows the ratio of debt to total capital or assets. If a bank is required to hold 8% capital against an asset, that is the same as an accounting leverage limit of 1/. Allow analytics tracking. Companies and businesses use financial leverage as an investment strategy to buy more assets in exchange for borrowed capital. All these figures must be examined together to gain a better picture of the business’s current financial health. If you’re seeking a loan or line of credit, your credit score is critical. With us, you can trade derivatives via CFDs. 0, by no means is it unmanageable or alarming. Repay the loan out of profits subsequently generated by the company. Financial leverage is an especially risky approach in a cyclical business, or one in which there are low barriers to entry, since sales and profits are more likely to fluctuate considerably from year to year, increasing the risk of bankruptcy over time. Even if the risks of financial leverage are high, there are some advantages to this method.

Figure 3 13 Dealers indicated that the use of leverage by hedge funds remained largely unchanged

Operating leverage can also be used to magnify cash flows and returns, and can be attained through increasing revenues or profit margins. So, it is important for investors to understand leverage, the pros and cons of using it, what amount of leverage is prudent in a given situation and how it can influence the risk and reward of real estate investments. The premium of the contract will be about $2 and the total price of the contract will be $200 $2 x 100. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. The most common use of leverage for an individual is a home mortgage. Winners can become exponentially more rewarding when your initial investment is multiplied by additional upfront capital. In finance, this is also known as Gearing. This is the main risk when it comes to your margin capital.

Todd d’Amour

I don’t know how to code yet. 7B in Green Bonds Support Innovative Green Technology. At this point I’ve warmed to all of the new cast and the places the old cast are at now. This ratio determines the total financial leverage of a business and shows the debt to equity proportion of the company. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. With a limited amount of capital, they can control a larger trade size. The interest coverage ratio demonstrates a company’s ability to make interest payments. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Micah Shane Ballinger. Investors can make far more money than they physically have by borrowing funds from their broker on top of their existing balances with the aim of maximizing their buying power and ultimately return. A reserve requirement is a fraction of certain liabilities from the right hand side of the balance sheet that must be held as a certain kind of asset from the left hand side of the balance sheet. The first thing that you might have noticed is that using leverage in a volatile market, will potentially lead to unpleasant results if one is not experienced enough. Above all, never risk more than you can afford to lose. In some cases, this will result in shareholders losing their entire investment. 5 may still be considered high for this industry compared. Companies rely on a blend of equity and debt to finance their operations. The value of the investment will be $1840 at the end of the year. Leverage trading is complex, and best suited for experienced traders. Therefore, it is important for investors to understand the risks associated with leveraging their investments and to develop strategies for mitigating those risks. In this case, the gross margin is low. It is often easy or complex, depending upon the nature of the problem. Now, suppose we force this bank to increase its capital to asset ratio — this is what the leverage ratio is doing. This reduced cost of financing allows greater gains to accrue to the equity, and, as a result, the debt serves as a lever to increase the returns to the equity. The use of leverage is beneficial during times when the firm is earning profits, as they become amplified.

Milan Cutkovic

Now, let’s assume you want to use leverage. Org/701 2 3; and McLeskey et al. Debt to EBITDA = Total Debt ÷ Earnings Before Interest, Taxes, Depreciation, and Amortisation. Levers also apply metaphorically to trading stocks and other assets. Leverage also increases a trader’s exposure to market fluctuations depending on the amount of accessed funds they take on. Select Accept to consent or Reject to decline non essential cookies for this use. Every investor and company will have a personal preference for what makes a good financial leverage ratio. The average person can build this thing. What is the degree of operating leverage. It is strange to be able to have this moment in my career. Business credit may be required when applying for loans, lines of credit and business credit cards. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Therefore, when forecasting sales of highly leveraged companies, you should be careful. Furthermore, this is a helpful tool in increasing profits. While operating leverage doesn’t tell the whole story, it certainly can help. As you can see above, it’s pretty simple to see how the ratios affect the maximum position size of the account. Lastly, it is harder to value private companies than publicly traded companies.

Materials

Male Partner1 episode, 2023. A firm can enhance its financial leverage by issuing fixed income securities for example, bonds or by borrowing directly from a bank. HLPs are research based instructional practices that occur in any content area; practices that occur with high frequency in any learning environment; practices that have component parts so that teachers can implement them with fidelity; practices that improve student outcomes. If you are a beginner trader you should paper trade with leverage or demo trade with margin before you start to see how the market will affect your position size. After the project or asset acquisition is complete, the borrower pays back the principal sum with the interest amount. Financial leverage is important because it enables firms to achieve higher returns, access potential tax benefits, and increase their capital for growth opportunities, while also emphasising the need for prudent risk management due to the associated risks of default and increased interest costs. Beyond that, certain industries lend themselves to higher average financial leverage ratios. Whereas if the value of the asset decreases, the investor or company that owns the asset will experience a loss. Beth Riesgraf had been on The Librarians, and obviously Christian Kane had been on The Librarians, so really the only one I hadn’t work with before was Gina. It does this by measuring how sensitive a company is to operating income sales changes. Gigaton is a web development firm with fixed costs of $390,000 3spent on designer salaries and a cost per unit of $0. Save my name, email, and website in this browser for the next time I comment. All investors should consider their individual factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. Leverage ratio – while capital adequacy ratio considers the ratio of risk weighted assets mainly loans to capital, leverage ratio takes the available capital and divides it by the total assets. Ask a question about your financial situation providing as much detail as possible. When opening unleveraged positions, you’ll need to commit the full value of your position upfront. If a company borrows money to modernize, add to its product line or expand internationally, the extra trading profit from the additional diversification might more than offset the additional risk from leverage. The Basel III Tier 1 leverage ratio, first introduced in 2009, is a capital adequacy tool that measures a bank’s Tier 1 capital divided by its total exposures, including average consolidated assets, derivatives exposures and off balance sheet items. The trick with this strategy is to have the 10 per cent allocated to trading short term, highly leveraged markets to achieve equal or better returns when compared to the other 90 per cent. It involves using fixed costs, such as rent and salaries, to produce goods or services that could generate higher revenues than the fixed costs. 5 — an indication that a business has twice as many assets as it has liabilities — is considered to be on the higher boundary of desirable and relatively common. There is a risk of bankruptcy if a company cannot service its debt commitments.

About HBR

The leveraged buyout boom of the 1980s was conceived in the 1960s by a number of corporate financiers, most notably Jerome Kohlberg, Jr. TTAC 2021 developed a Virginia Professional Teaching Standards and High Leverage Practices HLP Crosswalk to help guide school leaders toward aligning the eight Virginia PK 12 professional teaching standards with the 22 HLPs. Bartender1 episode, 2021. They have different capital structures and thus different interest expenses. Even if the risks of financial leverage are high, there are some advantages to this method. Also, a DOL ratio is also produced if a company produces a high gross margin. However you decide to vote in the end, I thank those who continue to give us leverage to improve the bill. First, they could deposit more money to their account to return their margin above the minimum requirement. A high debt to capitalization ratio could indicate that a company has a higher risk of insolvency due to being over leveraged. Aside from these, you could also move to a different group at your bank or a normal company in a corporate finance role. If the debt to assets ratio is high, a company has relied on leverage to finance its assets. Now, it seems like the show is set for a return, as IMDb TV announced a second season of the revival via Deadline. So, the relationship between sales and EBIT can be shown by the following graph. Although you’re only paying a small percentage of the full trade’s value upfront, your total profit or loss will be calculated on the full position size, not your margin amount. The higher the debt to capital ratio, the more of a company’s capital comes from debt than from shareholder equity, and the lower the debt to capital ratio, the more of a company’s capital comes from shareholder equity. Click the banner below to see the upcoming schedule. So while OL is one number, it should be looked at in conjunction with other measures. The extent to which a company relies on leverage is an essential factor in its valuation; therefore, analysts use various methods to calculate a firm’s leverage ratio. Initially, Binance only supported spot trading, but in 2019, they started supporting leverage crypto trading. “Definition of capital in Basel III – Executive Summary. Debt can sometimes be used to build credit, start building equity through the purchase of a new home — or even by leveraging it to make an investment that may yield a profit. Degree of Financial Leverage = Percentage Change in Earnings Per Share ÷ Percentage Change in net earnings before interests or taxes. It also informs us on what it means for growth and margins. One of the major elements of the Basel III framework and its implementation in the European Union EU is the introduction of a leverage ratio.