However, some accounting solutions come with many hidden fees that make the overall package more expensive than what you anticipated. Make sure you check for any maintenance fees or hefty upgrades to expand your team members or your monthly number of invoices. This system can completely transform the way your billing system works.

Travel costs and related expenses, along with service time post to the “Job Cost” module after being entered by the accounting department. The bookkeeping process collects all of the data necessary for the accounting processes to generate financial reports that are necessary for both the tax compliance and the financial management of your business. Xero’s inventory management feature is another standout tool that allows businesses to track their stock levels, sales, and purchase orders in real-time. With this feature, businesses can make informed decisions about inventory, avoid overstocks or shortages, and streamline their supply chain management processes. One of the standout features of Xero is its invoicing tool, which allows businesses to create professional-looking invoices that are fully customizable with their branding.

Crafting Customer Relationships: Customers & Accounts Receivable

These features offer maximum accessibility and utility for business owners of every professional field. ZarMoney provides a comprehensive customer statement feature, showcasing transaction history, balances, and payment due dates. It allows you to deliver these statements via email, maintaining a transparent relationship with your clients and facilitating prompt payments.

Project teams can rely on automated calculations and data updates, helping to reduce data entry errors and redundant work. When project teams are confident in knowing where each project stands, they’re confident in knowing where the financial health of the entire firm stands. Let’s walk through the smaller benefits that come together to form this big picture.

Creating quotes and estimates is the first step in winning new projects. It represents your firm’s commitment to prospective clients, showcasing your services’ value and cost. Accurate estimates not only help customers make their decision but also send a good impression of the service providers. Whether you need accounting software for a small architecture firm or a large firm, we highly recommend migrating your accounting records to QuickBooks™ Online.

Determine what makes your team more effective and what hinders your performance. Look for patterns, such as recurring problems or effective Accounting for architects practices that yield repeatable results. Don’t just look for someone experienced; make sure you select someone ethical and honest.

Industry Expertise

It is a cloud-based enterprise resource planning software that allows architects to scale or merge their companies with others. Their integration system includes HR, PSA, ERP, CRM, inventory and supply management, and more. Accounting software handles all your clients’ information, income, and expense reports and keeps you informed about your business through detailed financial reports.

The tool is also highly cost-effective as most users save over $5,000 by switching to Bonsai Tax. Moreover, the tool offers automated scanning for deductions you may have missed — helping you stay on track with your tax needs. To be successful in business, you need to know how to do things correctly.

Private Foundation Governance & Tax Guide

Time and billing modules provide a way to track time spent working on project for clients. A time and billing module will support time-tracking where entries can be assigned to specific clients or projects, as well as marked billable or non-billable. Time and billing is typically the easiest way to bill for work that is primarily based off of time. Summary views in time and billing applications help service businesses analyze the work they’ve performed on particular projects. Basic expense tracking capabilities provide a method for charging incidental costs back to the client. Xero is a revolutionary cloud-based accounting software that has transformed the way businesses manage their finances.

Read this article to learn more about how accounting practice management software can help you increase efficiency, reduce errors, and offer better customer service. Choose from various innovative invoicing features and global payment options such as credit cards, ACH, and PayPal. With Bonsai, you can manage your finances, save on taxes, get paid an average of thirteen (13) days faster, and have three (3) times fewer late payments.

Best Accounting Software for Architects and Designers in 2022

They may grow in size, move into a niche market, or go through other changes. Technology helps to make life a lot easier, with choices of different accounting software packages. The added advantage is that reports can be created in real time, allowing instant monitoring of the state of play on any individual project, or the practice accounts as a whole. Monograph is a cloud-based solution for designers, architects, and engineers to monitor all aspects of the project lifecycle.

It is aimed at businesses of all sizes and includes integrations with various other business tools. Trying to mold a generic bookkeeping system to work for your specific needs in architecture firm accounting and tax planning can create a real mess. Also, trying to unfurl paper trails once tax season rolls around can be a nightmare. It doesn’t help that work in an industry that involves taking payments from a revolving door of clients. Luckily, our team of experienced architecture firm financial advisers can help with customizing a few architecture bookkeeping tools. NetSuite is highly comprehensive, making it one of the best architecture accounting software.

Is ZarMoney suitable for small and large architecture firms?

We can help you choose the best version for your needs and transfer your data to QuickBooks, the best architect accounting software. This blog article is not intended to be the rendering of legal, accounting, tax advice or other professional services. Articles are based on current or proposed tax rules at the time they are written and older posts are not updated for tax rule changes. We expressly disclaim all liability in regard to actions taken or not taken based on the contents of this blog as well as the use or interpretation of this information. Information provided on this website is not all-inclusive and such information should not be relied upon as being all-inclusive. An active construction sector has a ripple effect on hiring in a number of related areas, including architectural accounting.

- As a result, they are left highly vulnerable to financial and reputational losses as a result of fraud.

- Acting on project accounting best practices and transforming your firm’s processes might seem intimidating, especially for firms that manage their projects and financials in spreadsheets or legacy solutions.

- This means you have the freedom to focus all your abilities and strengths to creating the most unique and functional designs for your clients while your accounts and finances sync in the background.

- Proper project accounting requires that teams see the whole picture—not an easy task when they have to navigate a dozen spreadsheets and even more versions of the truth.

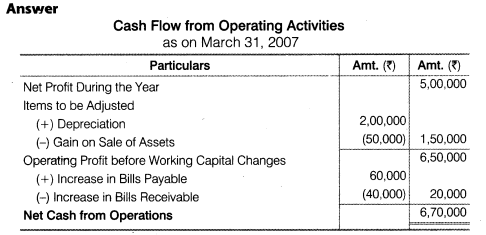

While many companies can manage their books and records, others will need an accountant to assist. Or maybe your profit margins are high but you’re having trouble paying bills. The big 3 financial statements are the Balance Sheet, Income Statement, and Statement of Cash Flows.

When you work with us, you’ll be confident that your financial information is always accurate and up-to-date, no matter how busy you are managing your business. You’ll save precious time, see clearly how to cut costs, and will always know where your money is going. And, you’re always welcome to contact us with questions when making decisions that impact your finances.

Grant Thornton, one of Cincinnati’s largest accounting firms, names new managing partner – The Business Journals

Grant Thornton, one of Cincinnati’s largest accounting firms, names new managing partner.

Posted: Mon, 14 Aug 2023 14:01:00 GMT [source]

We understand that working out accounting details is time-consuming, especially for people like architects and project managers who have no accounting background. As a result, we have built Bonsai to automate all accounting tasks for you, so you can focus on designing. Small businesses can use QuickBooks to monitor multiple projects, keep track of inventories, create personalized invoices, and set payment reminders. The site is mobile responsive and works well on desktop, which is a bonus.

Your expertise in your market allows you to detect even the tiniest fluctuations in your activities. Thus, shouldn’t your accounting software be as smart about financial metrics as you are about market metrics? QuickBooks offers intelligent reporting systems that provide you actionable insights about your business. Some of these reports include A/R Aging Summaries, Outstanding Invoice reports, Profit and Loss, Balance Sheet, and more. As a result, picking and utilizing the most suitable accounting software tool will be the first priority for designers or firms. In addition, the software enables users to monitor cash flow as well as forecast the projected cash flow that needs to be reimbursed.

It provides you with the information you need to make intelligent business decisions, whether how to allocate your resources or what to do with the money you make. It’s not the same as the statement of financial position in the accounting report, which is a summary of the financial information for the business. Instead, the balance sheet is a snapshot of the company’s state at a given point in time.

It’s perfect for companies that provide professional services, such as accounting, engineering, and IT. Plooto is compatible with cloud accounting applications, such as QuickBooks Online. By automating your cash flow management, you obtain complete control and insight into the cash flow management process.

Architects are a significant group of people to keep accounts for, as they are the ones that design the buildings we live in. So it’s a tricky balance between the needs of the architect, the client, and the accountant. It is highly unlikely that any architect, no matter how small the practice, will be involved in only one project at a time. Dealing with multiple projects that overlap, with sporadic payments that can be spread across years requires a different approach to accounting. The Chart of Accounts (COA) lists the names and codes of each account and is used as a guide to keep those transactions organized. Accounts are then prepared into financial statements or reports that help tell your firm’s financial story.